oswego county ny property tax map

For other GIS inquiries for Oswego County please see the contact below. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Map Of Richland Oswego Co N Y From Actual Surveys Library Of Congress

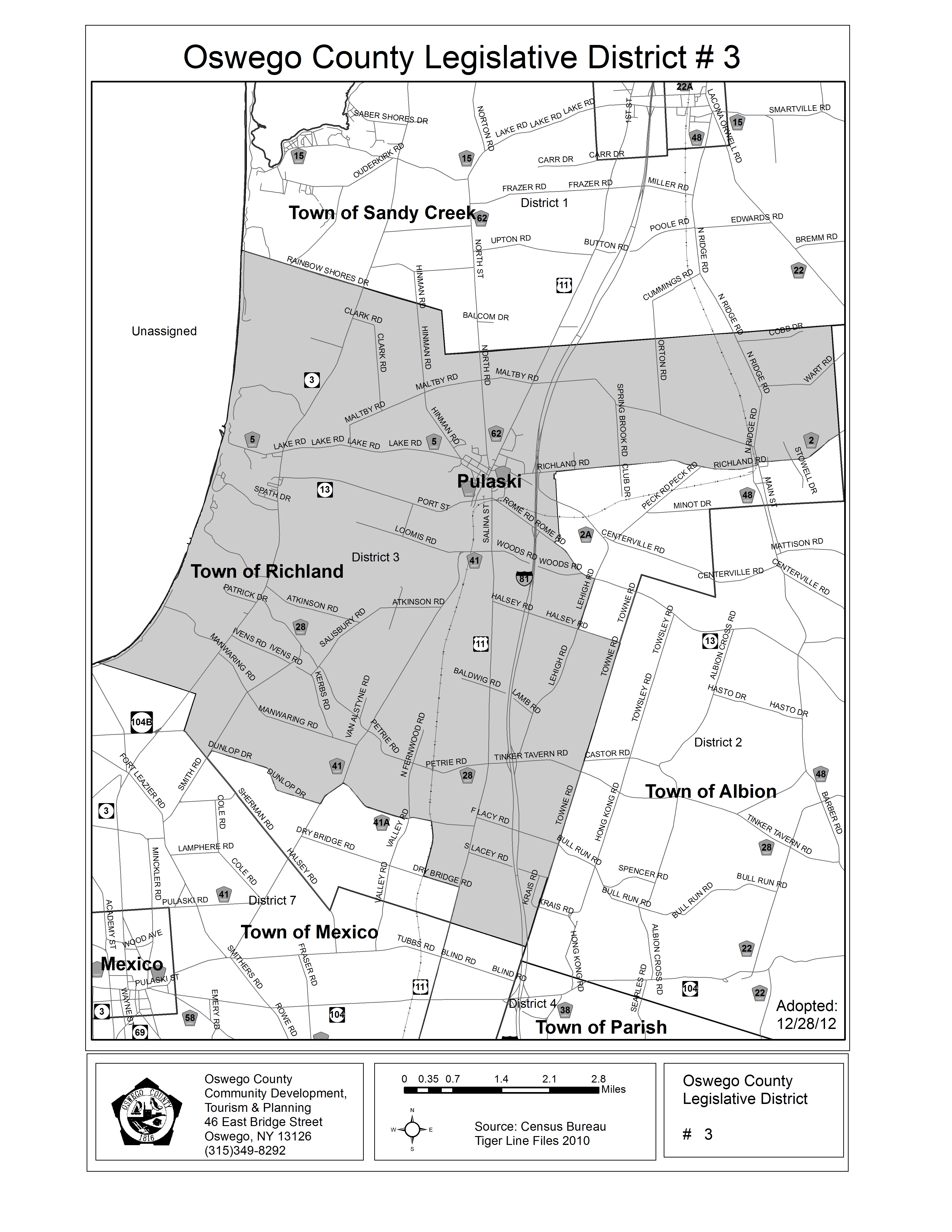

Oswego County NY Map.

. In 1970 the state legislature passed the Assessment Improvement Law which. The lots are the individual land parcels found on an assessment roll. In order to comply with the AIL the tax maps had to conform to a uniform measurement scale.

Discover analyze and download data from. While utilizing the online Tax Map Explorer is the most convenient way to search for and view parcels on the. Oswego County has one of the highest median property taxes in the United States and is ranked 313th of the 3143 counties in order of median property taxes.

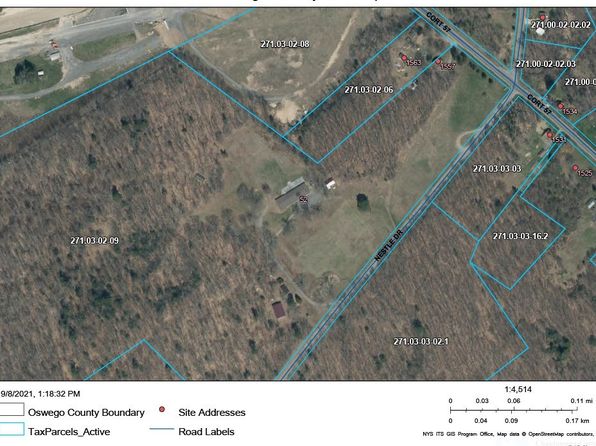

GIS stands for Geographic Information System the field of data management that charts spatial locations. Oswego County with the cooperation of SDG provides access to RPS data tax maps and photographic images of properties. See detailed property tax information from the sample report for 836 N Wart Rd Oswego County NY.

There are 4 Assessor Offices in Oswego County New York serving a population of 119833 people in an area of 952 square milesThere is 1 Assessor Office per 29958 people and 1 Assessor Office per 237 square miles. The County is working towards integrating all tax information to our system. Not all municipalities have tax records online or have the ability to pay taxes online.

Lawrence CountyFor more details about the property tax rates in any of New Yorks counties choose the. The cities and villages were mapped at a scale of 1 inch 100 feet or 1. Our office also provides services and support to the local assessment community local governments and school.

Contract or payment agreement payments cannot be made electronically. 46 East Bridge Street. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The department of Real Property Tax Services is an administrative agency of Oswego County that is tasked with maintaining county tax maps geographic information data and administration of Geographic Information Systems GIS. March 30 2022 Rabies Clinic.

Information on the Oswego County tax map. Map of Oswego County showing state owned lands open to public recreation. Oswego County Property Records are real estate documents that contain information related to real property in Oswego County New York.

The median property tax in Oswego County New York is 2354 per year for a home worth the median value of 88000. Information on the Oswego County tax map. Municipal name School district name Class Basic Enhanced.

Real Property Tax Services. For early or defaulted contract or payment agreement pay off amounts please contact our office at 315-349-8393. The data available on the Oswego County Real Property Tax Service Image Mate Online Database including all Geographic Information Systems data maps tables numbers graphics and text hereinafter collectively referred to as the Information is provided on an As Is As Available and With All Faults basisNeither Oswego County nor any of its officials and employees.

Information on the Oswego County tax map. Download in CSV KML Zip GeoJSON GeoTIFF or PNG. Take the next step and create storymaps and webmaps.

Tax maps and images are rendered in many different formats. Those sections are further broken down by block with each block containing lots. The following list contains information on the online availability of local tax records.

The AcreValue Oswego County NY plat map sourced from the Oswego County NY tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Oswego County Office of. In New York Oswego County is ranked 36th of 62 counties in Assessor Offices per capita and 41st of 62 counties in Assessor Offices per square.

Image Mate Online is Oswego Countys commitment to provide the public with easy access to real property information. New York has 62 counties with median property taxes ranging from a high of 900300 in Westchester County to a low of 167400 in St. See Property Records Deeds Owner Info Much More.

March 31 2022 Last Day To Pay TownCounty Taxes To Local Tax Collector. Oswego County is Hiring. Oswego County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Oswego County New York.

The county tax map is broken down into approximately 1133 sections and subsections. Discover our beautiful county. Counties cities towns villages school districts and special districts each raise money through the.

Find API links for GeoServices WMS and WFS. Oswego County collects on average 268 of a propertys assessed fair market value as property tax. Analyze with charts and thematic maps.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Delinquent taxes are handled by the County Treasurer except for taxes in the City of FultonFor property taxes within the City of Fulton please contact the Fulton City Chamberlain. In New York State the real property tax is a tax based on the value of real property.

Search Any Address 2. Click the Read More link for more information on exams recruitments and. In Oswego County this update to the tax maps was completed in 1975 and was based on accurate land base information derived from a 1974 aerial flyover and orthophoto mapping project.

Oswego County Ny Luxury Homes For Sale 253 Homes Zillow

Oswego County Today Weekly News Roundup January 30 February 5 Oswego County Today

Two Dozen Tax Delinquent County Properties Could Be Transferred From The County To The Oswego County Land Bank Next Month Oswego County Landbank

Oswego County Treasurer S Office Announces On Line Payment System For Delinquent Taxes Oswego County Today

Phil Church Oswego County Adm Oswegocounty Twitter

How Healthy Is Oswego County New York Us News Healthiest Communities

Fulton Department Of Motor Vehicle Reopens Oswego County Today

Oswego County Habitat For Humanity Inc Launching New Home Ownership Opportunity Oswego County Today